Casino Winning Taxes Amount

Posted : admin On 4/12/2022Discovering you have a winning lottery ticket is thrilling, especially if you hit the big jackpot. However, you won’t be able to keep the entire amount. Under federal law, lottery winnings are taxable, just like the income you earn at your job. You must report all gambling winnings on your federal tax return, and many. Mar 09, 2020 $1,500 or more in proceeds (the amount of winnings less the amount of the wager) from keno Any gambling winnings subject to federal income tax withholding. Gambling winnings are fully taxable and must be reported on your tax return. Here are the top seven facts the Internal Revenue Service wants you to know about gambling winnings. When I input the numbers into the 511NR-1 worksheet, I put my Texas income and Oklahoma gambling winnings combined in Line 1 on the federal amount, and only the Oklahoma gambling winnings on the OK Amount.

- Factoid: Twenty-five years ago 2 states had legalized gambling and 48 did not. Now 48 do and only 2 do not (Hawaii and Utah.)

- Factoid: Nevada gambling revenue was $1 billion in 1975 ...$10 billion in 2004 and is projected to be $15 billion in 2009.

'Las Vegas was built for people who are really bad at math....' ...Penn Jillette (Penn & Teller, now at the Rio!)

'There are two times in a man's life when he should not speculate: when he can't afford it and when he can.' ...Samuel Clemens, also known as 'Mark Twain' (1835-1910)

In the last decade, entertainment, shopping and fine dining have replaced gambling as the top attraction for visitors to Las Vegas. Many hotels get more than half of their revenue from non-gambling sources.

Although tourists no longer list gambling as the primary reason for their visit, almost all are willing to risk an average of $500 each trying to hit that elusive jackpot.

Nationwide, casino gambling is a $50 billion business. And 20 percent of that amount comes from just one state ...Nevada. One third of all Nevada general tax revenue comes from state gambling taxes.

The state of Nevada and casinos like to call it “gaming” since ”gambling” has such an negative ring to it. We agree. “Gaming” is a better word for the games of chance legally offered in Las Vegas. Games are played for entertainment. And this is how you should treat the money you risk in Las Vegas in hopes of hitting “The Big One.” Play for fun and the “possibility” that you might win. NEVER take Las Vegas gambling seriously.

Gambling laws in NevadaCasino Winning Taxes Amount Earned

Las Vegas gambling was legalized in 1931. The Nevada Gaming Commission and Control Board develops and administers all gaming regulations. Their website can make interesting reading. Casinos with more than 15 slot machines pay an annual tax of $250 on each one. There is also an additional monthly tax of up to 6.75% on gross gaming revenue ...a percentage that is the lowest in the U.S.

Anyone working as a gaming employee must be registered with the state and have a valid gaming work permit. This includes all casino workers except bartenders and cocktail waitresses.

You must be 21 to enter a casino, gamble ...or purchase or consume alcoholic beverages. If you look young carry a state-issued ID with photograph such as a driver’s license. Children are permitted in the casino public walkways but are not allowed to be near slot machines or gaming tables. You are allowed to carry open alcoholic beverage containers on the street, but not in a vehicle.

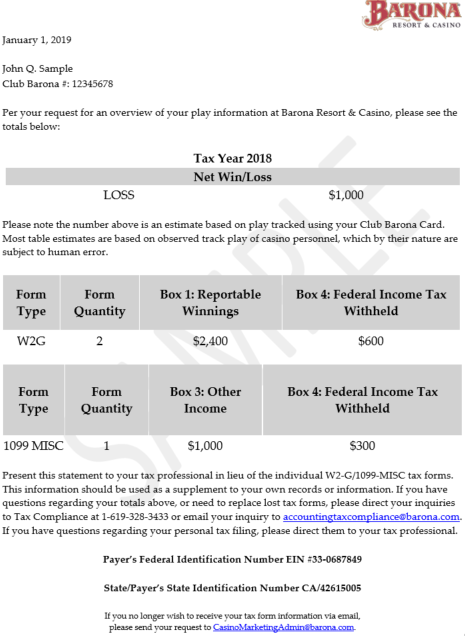

Taxes on gambling winningsThere are some things you should know if you are lucky enough to win. The Internal Revenue Service (IRS) requires all casinos in certain instances to withhold federal taxes if you win over a certain amount. The percentage withheld ranges between 25 and 30 percent depending on how you won. Here is how it works.

If you had gambling winnings, the casino is required by the IRS Information Reporting rules to withhold 28% as income tax if you do not provide a documented TIN (Taxpayer Identification Number, that is, your Social Security Number.) We have heard of cases where it is withheld no matter what. The withholding tax is 30% if a foreign gambler. The tax rate is 25 percent if the amount is over $5,000 (except for non-resident aliens.)

When your winnings exceed a specified threshold and/or tax is withheld, the casino will give you an IRS Form W-2G showing the amount you won and the amount of tax withheld. Report (and take credit for the tax you paid) on your IRS Form 1040 tax return at the end of the year. (Only use Form 1040 if you had gambling winnings; you cannot use any other form.)

Generally, gambling winnings are reportable to the IRS if the amount paid is (a) $600 or more and (b) at least 300 times the amount of the wager. This requirement primarily applies to lotteries, sweepstakes and other big winnings from small bets. It does not apply to winnings from bingo, keno, and slot machines.

Casinos report gambling winnings for these games to the IRS when a player wins $1,200 or more from a bingo game or slot machine or if the proceeds are $1,500 or more from a keno game. When you exceed these amounts, the casino may withhold taxes and will provide you with IRS Form W-2G. They keep the original and give you two copies of the form. (If state income tax withholding is required on gambling winnings in your state, additional taxes may be withheld.)

The rules are different for table games (such as blackjack, baccarat, craps, roulette or other spinning wheel games.) Since Nevada casinos do not know the amount you started with, they are not able to determine how much you won (...your taxable gain.) As a result, federal law provides that there is no withholding or even reporting of table game wins to the IRS. It therefore follows that table game winners probably do not report their gambling profits to the IRS.

You not only pay taxes on gambling profits, but you can also claim gambling losses as an itemized deduction as well. But you must keep some kind of documentation (such as a diary or tickets) to substantiate the amount and nature of the losses. In any event, you cannot claim gambling losses that exceed your winnings.

Managing your moneyGreed is the downfall of most players. The odds that you will win if you play long enough is statistically wrong ...as is; having doubled your money, you next try to quadruple the winnings (and end up losing it all.) Both concepts have built a lot of nice hotel-casinos in Las Vegas.

My system for managing gambling money is simple. I budget $100 a day which, according to statistics, is about average for Las Vegas visitors. If I am on a five day vacation, I put $100 in each of five dated envelopes ...a total of $500. I ration the money throughout the day and stop when I lose my hundred and do other things. I might stop when I double my allotment. In any event at the end of the day, I either am ahead or behind. If I am ahead, I put whatever portion of the $100 I have left (hopefully it is more than $100) back in the same dated envelope and place it in the room safe that hotels provide. Tomorrow I play with the money in following day’s envelope. The most you can lose is $100 on any given day ...or $500 for your trip. I am happy if I break even ...and you should be too. Once in a while I go home with “their” money. In recent years I have done better. I will tell you how later.

The bad news: There are no casino games or bets where the house does not have a clear advantage. The odds either favor the house ...or they get a commission. And if you are not familiar with basic information about the games you play or bets you make, you are just about a guaranteed loser. In short, casino owners are in business to make a profit. They did not build all those gorgeous hotels by giving away money.

The good news: The reality is that if you are lucky you can win ...and the drinks are free. But statistically the chances are against winning. So the cardinal rule is, over the long haul, whether playing the slots, table games, betting on sports or risking money on anything; you will probably lose. But some bets are better than others.

It is beyond the scope of this website to provide in depth strategy on how to gamble and win in Las Vegas. Many books have been written on the subject and - trust me - none work over the long haul ...or are illegal.We will, however, cover the most popular games and things you should know as a beginner to have fun and minimize your loss ...and maybe make a few bucks.

Let the games beginBlackjack (21) is either dealt by hand with one or two decks. Multiple Deck 21 is dealt from a box called “the shoe.” Everyone in Blackjack plays against the dealer. Roulette consists of a spinning wheel marked with numbers 1 through 36 (18 red, 18 black) and American Roulette has a green 0 and 00 ..a total of 38 possibilities. You win if your number, combination of numbers or color comes up. To play Keno, you select a minimum of 4 but no more than 10 numbers on a ticket between 1 and 80. Twenty of the 80 numbered balls are drawn and you win if all your selected numbers are chosen. Craps is a complicated dice game which we do not recommend for first-timers. There are many other table games (and variations) as well. More and more people are playing poker these days and we will also have a little to say about that later.

By far, however, the most prevalent pastime in Las Vegas is playing the slot machines ...and video poker. We will cover the games of chance and sports betting in this chapter ...which you should play, where you should play and the odds of winning.

NEXT PAGE: 10.2 SLOT MACHINES ...AND VIDEO POKER... ⇨

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

This article was fact-checked by our editors and Christina Taylor, MBA, senior manager of tax operations for Credit Karma Tax®.

Hit it big playing the lottery? You’re probably thinking about how you’ll spend all that sweet cash. But first, Uncle Sam is going to want his cut.

The Internal Revenue Service considers lottery money as gambling winnings, which are taxed as ordinary income. The total amount of tax you pay on your lottery winnings will depend on multiple factors, including the state where you live and whether you take the winnings as a lump-sum payment (one check for the full amount after taxes have been withheld) or an annuity (smaller annual payments that are paid out and taxed over time).

Although you probably won’t be able to completely escape the tax man, you may be able to offset taxes on lottery winnings by claiming deductions you qualify for. Here are some things to know about paying federal income taxes on lottery winnings. Keep in mind tax rules may vary for state and local income taxes, so for the purposes of this article, we’re talking about federal income taxes only.

Do I have to pay taxes on lottery winnings?

The IRS considers most types of income taxable, unless the tax code specifically says it’s not. Because lottery winnings are considered gambling winnings, which are definitely considered taxable income, the IRS will want its cut.

For lottery winnings, that means one of two things.

- You’ll either pay taxes on all the winnings in the year you receive the money — for winnings paid out as a lump-sum payment.

- Or you’ll pay taxes only on the amount you receive each year — for winnings paid as an annuity.

Take note: If you receive interest on annuity installments that haven’t been paid to you yet, that interest must be included in your gross income for the tax year you received it.

How will the IRS know about my lottery winnings?

If your winnings are $600 or more, the lottery agency is supposed to give you a Form W-2G that you’ll have to file with your federal income tax return if the agency withheld federal income tax from your winnings.

Casino Winning Taxes Amount Calculator

The lottery agency is also required to send a copy of this form to the IRS if your winnings are $600 or more, so it’s important to accurately report your winnings on your federal tax return.

And even if you don’t receive a W-2G for your lottery winnings (or other type of gambling payouts), you’re still expected to report those winnings as income on your federal tax return.

How could winning the lottery affect my taxes overall?

Getting a huge financial windfall can be life-changing, but it doesn’t change everything — you’ll still have to pay taxes and bills. Federal and state taxes can decrease the amount of money you ultimately receive, so it’s crucial to understand taxes on lottery winnings when you strike it big.

Whether you’re all-in on your prize money and accept it as a lump sum or you’re receiving payments over time, winning the lottery generally increases your income. Taxes are calculated based on your taxable income for the year, so if the extra income from lottery winnings moves you into a higher tax bracket, you’ll typically end up paying more income tax.

If you fail to report taxable income (including lottery winnings) on your tax return, you could owe additional tax, interest and even penalties.

What is the tax rate for lottery winnings?

Depending on where you live, you may need to pay taxes on lottery winnings to your state and local governments in addition to the federal government.

Federal tax

Right off the bat, lottery agencies are required to withhold 24% from winnings of $5,000 or more, which goes to the federal government. But, depending on whether your winnings affect your tax bracket, there could potentially be a gap between the mandatory withholding amount and what you’ll ultimately owe the IRS.

Even if your lottery winnings don’t boost your tax bracket, if the federal government withheld too much tax on your lottery winnings, you might get a refund at tax time.

State and local tax

Each state has its own rules on taxing lottery winnings, so check both your state’s tax website and your city’s tax website for information. For example, if you live and win in New York City, the state government will withhold 8.82% and the city will withhold another 3.876% — on top of your base federal withholding of 24%.

Seven states — Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming — don’t have income tax, so big winners in those states won’t pay state taxes on prize money. Some other states don’t have a state lottery at all.

And three more states — California, New Hampshire and Tennessee — exclude their state lottery winnings from taxable income. But before you play the lottery in a different state, check the rules so that you know whether any taxes will apply to your winnings.

Should I take a lump sum or annuity payments?

Whether you get to choose between a lump sum or annual installments for your lottery payout can depend on different factors, like state lottery rules and how much you won. Either way, here’s how the two payout types will affect your federal income taxes.

Lump-sum impact

Receiving your winnings as a single lump sum could potentially bump you right into the highest bracket for the tax year in which you win the lottery. That would mean if you win a very large amount, your income over a set threshold ($518,401 for single taxpayers and $622,051 for married couples filing jointly, for 2020) would be taxed by the IRS at 37%.

“If you decide to have a lump sum payment, that would probably put you in the higher tax bracket for that one year,” says Megan McManus, CPA and owner at Megan McManus, CPA.

For example, if you’re single and your current taxable income is $40,000, a $1 million lottery payout, taken in a lump sum, would increase your total income to $1,040,000 for the tax year. At the federal level, the portion of your income over $518,401 would be taxed at 37%. But all the lower tax rates would also apply to portions of your income less than that threshold. Here’s what you’d pay (rounded to the nearest dollar).

- 10% on income up to $9,700 = $970

- 12% on the next $29,775 = $3,573

- 22% on the next $44,725 = $9,839

- 24% on the next $76,525 = $18,366

- 32% on the next $43,375 = $13,880

- 35% on the next $306,200 = $107,170

- 37% on the last $529,700 = $195,989

If you add all that up, your total federal income tax obligation for the year would be $349,787.

Annual payments impact

Depending on your income, receiving annual payments will also likely affect your tax bracket — but the immediate financial impact could be less.

“The annuity payments would probably allow you to be in a lower tax bracket each year,” McManus says.

Let’s look at the above scenario with the same amount of lottery winnings broken out into 30 annual payments of about $33,333.

With the annuity approach, your taxable income would increase to just $73,333 in the year you won the lottery (assuming other factors like a wage increase didn’t boost your taxable income). The highest federal tax rate that would apply to your income would be just 22%. Here’s what you’d pay (rounded to the nearest dollar).

- 10% on up to $9,700 = $970

- 12% on the next $29,775 = $3,573

- 22% on the remaining $33,858 = $7,449

Your total federal income tax obligation for the year in which you win would be just $11,992.

Learn more about the marginal tax rate and what it means for your winnings.

How can I offset federal taxes on lottery winnings?

If you’ve won the lottery, the IRS expects you to report it as income on your tax return. And Uncle Sam is going to want his share whether you receive your winnings as a lump sum or annual payments. But there are ways to try to offset the increased tax obligation your lottery winnings will cause.

Casino Winning Taxes Amount Taxes

Claim deductions

Deductions are dollar amounts the IRS allows you to subtract from your adjusted gross income, or AGI, if you meet the requirements. This lowers your taxable income, which in turn can reduce your tax obligation. Here are two possible deductions (if you itemize).

- Charitable donations — You may be able to deduct the value of your charitable contributions from your income as long as the organization is a qualified tax-exempt organization — but certain conditions and limits apply. For example, you can only deduct cash donations that are equal to no more than 60% of your AGI.

- Gambling losses — You can deduct your gambling losses (like the cost of lottery tickets that you didn’t win on) as long as they don’t exceed the winnings you report as income. For example, if you report $1,000 in winnings but you have $2,000 in losses, you can only deduct $1,000.

Play the lottery in a pool

If you join a pool with others to buy lottery tickets, then any potential lottery prizes will be smaller because you’re sharing it — but your tax hit will be smaller, too.

“You’ll only be taxed on your portion of the income,” McManus says, “so if you receive a third of the winnings, you would only pay tax on that third.”

To make sure you’re taxed correctly, document how much of the winnings go to each person in your group. Ask the lottery agency to cut checks for each person in the pool instead of having one person collect and distribute the winnings. This may help ensure you only pay taxes on the amount you actually receive.

What’s next

Winning the lottery could change your life by giving you a certain level of financial freedom. But before claiming your prize, consider speaking with a financial or tax adviser who can help you understand the potential tax impact of your winnings and plan the best way to manage your windfall.

Consider how you plan to use the money.

“If you want to buy a house or put your kids through college, you might need the funds now, as opposed to taking annual payments,” McManus says.

But if your objective is to ensure a steady stream of income, annual payments may be more appealing to you.

Whether you receive your lottery winnings as a lump sum or annual payments though, you’ll still have to pay the federal government — and possibly your state and local government — their share of your winnings. So it’s important to have a plan for how to best save, invest and grow the winnings you’ll keep.

California Casino Winning Taxes

Relevant sources: Topic No. 419 Gambling Income and Losses IRS: Publication 538 New York Lottery General Rules IRS: Pay As You Go, So You Won’t Owe

Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years. She codeveloped an online DIY tax-preparation product, serving as chief operating officer for seven years. She is the current treasurer of the National Association of Computerized Tax Processors and holds a bachelor’s degree in business administration/accounting from Baker College and an MBA from Meredith College. You can find her on LinkedIn.